How does a EOT work

How does an EOT work?

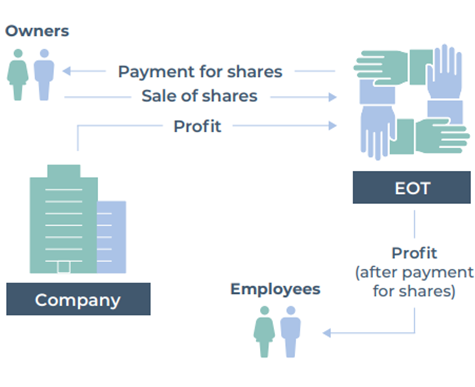

EOTs offer a different approach to using shares as an incentive. The indirect model means that a trustee holds shares collectively on behalf of the employees. This avoids the administrative and tax complications of direct share ownership. Some employee-owned companies have a mix of direct and indirect employee ownership. These hybrid models are also compatible with EOT structures.

What this means:

Tax efficiency

The government sought to encourage the ‘John Lewis economy’, which was reflected in its commissioned Nuttall Review of Employee Ownership, published in July 2012. This, in turn, resulted in Schedule 37 of the Finance Act of 2014, which introduced generous tax reliefs for employee-owned firms with indirect employee majority share ownership through EOTs.

There are tax benefits for both owner-vendor and employee-buyer. The most significant elements of this are:

For the vendor

There is a total capital gains tax (CGT) exemption on all gains made when a majority interest is sold to an EOT. If, on the other hand, shares are sold outside of this structure – for instance, in a trade sale or MBO – the vendor would pay 10% CGT after Business asset disposal relief (BADR, formerly entrepreneur’s relief) to the first £1m of lifetime qualifying gains by individuals, up to £100,000. There is no risk of CGT clawback after the year of completion and the following financial year.

For the employee

Under Schedule 37 of the Finance Act, the company is allowed to pay annual income tax-free cash bonuses of up to £3600 per employee. Because it is a bonus, not a dividend, the company does not have to be in profit.

EOT Qualification Requirements:

- Trading company or main company of trading group

- EOT must have controlling interest

- No more than 40% of employees can be continuing shareholders or connected directors/employees

- EOT trustees must distribute profits evenly among eligible employees.

Funding your EOT

A common obstacle to converting an existing business to employee ownership is the limited availability of capital funding. The EOT framework offers capital gains tax relief to business owners

who can self-fund a business conversion. Although employees can finance a buy-out with their own cash, in practice this is usually a minor source of capital.

Learn more about the facts, eligibility, benefits and funding of adopting an EOT for your business in our dedicated hub here.