Why alternative lenders have become mainstream for M&A funding

Why alternative lenders have become mainstream for M&A funding

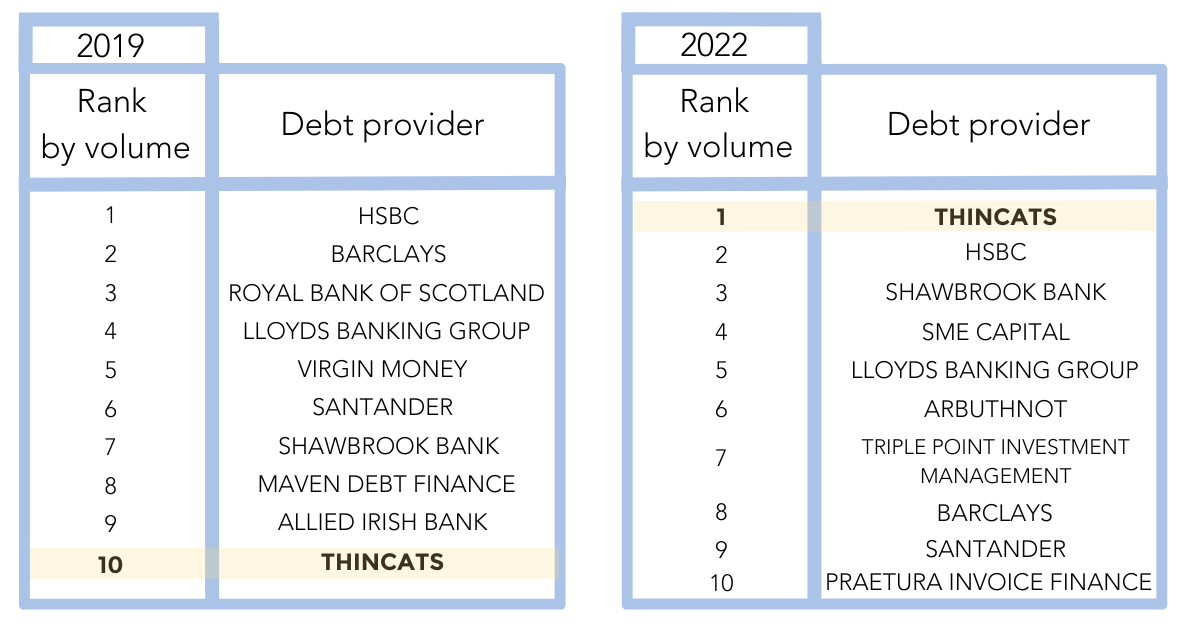

The annual M&A Review published by Experian is eagerly awaited by the business finance community as a source for understanding overall national, regional and sectoral M&A activity, but also for comparing how firms are performing against their peers. League tables ranking the volume of deals handled by legal advisers, financial advisers, debt providers and capital providers provide useful insight on the activity of the main participants in the UK M&A market.

What is not apparent from reading individual annual reports is how some trends move over time. A key trend that has been developing over several years, but has accelerated recently, is the increased use of non-bank lenders for funding M&A transaction.

Leading the way for alternative lenders is ThinCats, who in 2022 were ranked as the most used debt provider for M&A transactions. This is the first time that a lender other than a “big 4” bank has topped the table, so represents a significant changing of the guard. To give some historical context, as recently as 2019 the top 4 slots were occupied by the “big 4” banks with ThinCats ranked at no 10.

So why are advisers to these M&A transactions increasingly recommending specialist lenders like ThinCats?

As someone who worked for a “big 4” bank for many years before joining ThinCats, I believe we have the edge over traditional lenders in a number of key areas, which is confirmed from my regular conversations with corporate finance advisers.

Mike Hackett, Head of Business Development

Speed – we look to fund within 4-6 weeks of an initial enquiry depending on the quality of information available

Flexibility – we assess every business on its own merits meaning we create bespoke funding solutions including flexible repayment and covenant structures aligned to our borrowers’ business plans

Sector expertise – we have specialist skills in healthcare, technology, leisure and in funding PE-backed businesses, which aligns well with the areas experiencing the highest levels of activity as detailed in the Experian M&A report 2022.

Personal service delivered as one team locally – our origination, credit and transaction management teams work closely together on a regional basis meaning we develop long-term relationships with regional business finance communities.

Having come from the private equity industry focusing on special situations investing, I think there are a couple of elements in our approach to credit assessment which are particularly well-suited to funding M&A transactions

Greg Beamish, Head of Credit

Behave like investors rather than one-off lenders – As 75% of our funding is cash flow lending, we need to have confidence in the future performance of the businesses that we support. This not only involves a deep dive into the financials, but also a thorough assessment of the management team’s capabilities and commitment. As a medium-sized business ourselves lending capital from our own balance sheet, we want the businesses we fund to succeed. It’s why we seek to become long-term partners with the aim of providing further follow-on funding to support the growth of our borrowers.

More relevant data – Our proprietary credit model, PRISM, was built specifically to assess mid-sized businesses giving us speed and accuracy in determining credit risk and pricing. Containing millions of data points on every mid-sized business which has traded since 2007, the model is continually updated.

More generally, I believe that corporate advisers and PE sponsors have a much better understanding of the capabilities of alternative lenders compared to just a few years ago. We find that once we fund one transaction for, say, a PE investor, further opportunities quickly follow.

Another advantage is we have a very clear corporate objective: helping mid-sized businesses thrive by providing bespoke funding solutions. Because it’s all we do, we are not distracted by the multiple corporate challenges and sometimes conflicting priorities faced by the traditional bank lenders.

Learn more in the Experian M&A Review 2022