ThinCats tops table of debt funders for M&A transactions in 2022

ThinCats has continued to drive the rise of non-bank lenders as a source of funding for UK businesses by becoming the first alternative lender to top Experian’s annual table of M&A debt providers. In Experian’s 2022 M&A Review ThinCats provided funding for 71 transactions ahead of HSBC, who have ranked as the top provider for many years, funding 65 deals.

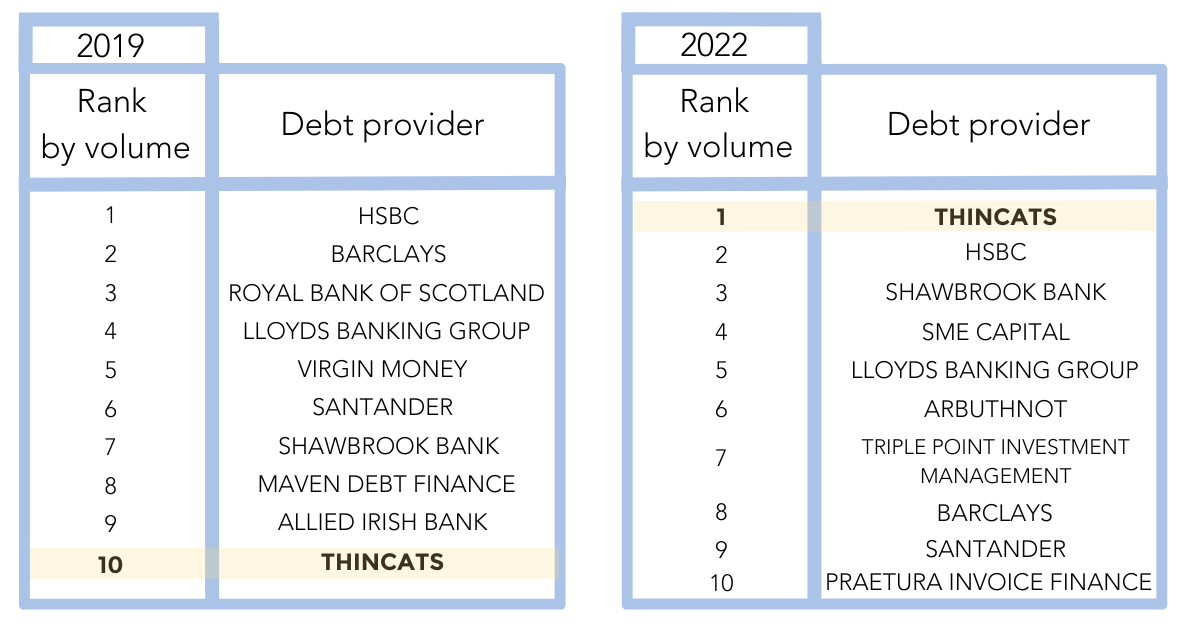

The speed with which alternative lenders have increased their share of M&A funding is highlighted by comparing the table for 2022 with 2019. In 2019, of the top 10 providers, 8 were banks with the “big 4” taking the top four spots. By 2022 three of the “big 4” were ranked in the top 10 with one making it into the top four.

Commenting on the review Amany Attia, ThinCats CEO “This report confirms that non-bank lenders are delivering a genuine alternative to the previous business funding model. For ThinCats to be ranked ahead of all the “big 4” banks is a significant achievement, reflecting our commitment to providing an outstanding service to our borrowers and their advisers. It’s particularly pleasing to have funded multiple buy-and-build transactions for our existing borrowers in our role as a long-term funding partner.

“The report shows that despite a drop in the number of large M&A transactions during 2022, activity within the lower-mid-market, which is where we focus, remains strong. The report also highlights the strength in the technology, healthcare and hospitality sectors and the high proportion of PE- backed transactions, all of which echo our own experience.

“The momentum from 2022 has continued into the new year where we recently provided our highest ever amount of funding for the month of January. With substantial amounts of capital to deploy, we look forward to supporting more mid-sized business with their growth ambitions during 2023.”

Read the full Experian M&A Review 2022 here