SME Optimism for Business Growth Remains Strong

We canvassed opinion from over 2000 SMEs in the UK, to better understand business sentiment, appetite for finance and views on the wider business environment. As the Chancellor prepares to deliver the Budget later this month, our latest research reveals an interesting shift in sentiment among UK SMEs:

Headline results

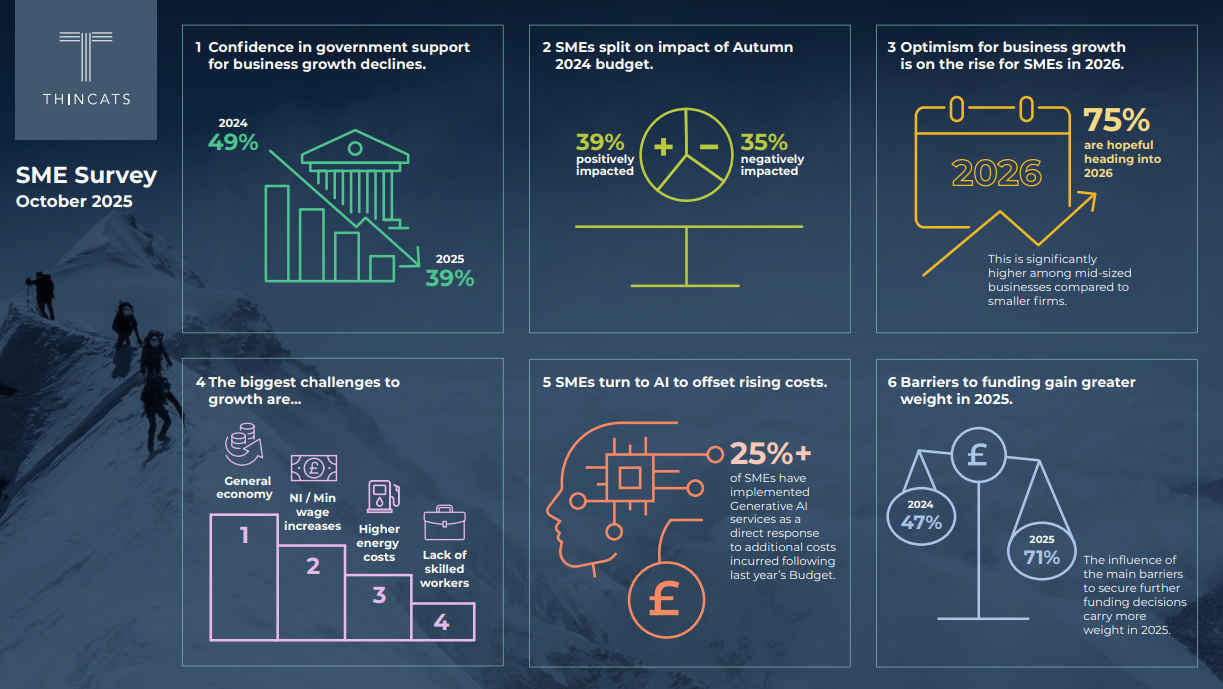

The data paints an optimistic picture when it comes to business leaders’ outlook for their own organisations. Three-quarters (75%) of SMEs are confident about achieving growth in the next 12 months - and confidence is strongest among mid-sized firms.

This contrasts with the concerns in the Government’s ability to create the right environment for business growth where confidence has fallen over the past year - from almost half of businesses (49%) to just 39% today.

While confidence is much higher among mid-sized companies (employing 50-249 people) with 50% expressing confidence, the data among microbusinesses (1-9 employees) 26% and sole traders (23%) shows real dissatisfaction within the private sector.

A Challenging Business Environment

When asked about the biggest challenges to growth, nearly four in ten businesses (39%) pointed to the wider economic environment, with weak demand and delayed investment decisions weighing heavily. Added costs from National Insurance and National Minimum Wage increases (36%), alongside inflation (36%), are also top of mind. Energy and fuel costs (26%) and the ongoing difficulty in recruiting skilled workers (22%) add further pressure.

Again, there are variations across business by size. Inflation, skills shortages, balancing investment and global tariff uncertainty are challenges being felt far more acutely among businesses operating in the mid-market, while the weak economy and access to finance are more acute among smaller businesses and sole traders.

Interestingly, despite last year’s Autumn Budget introducing additional costs and mixed sentiment, only 35% of respondents said it had a negative impact on their business. A quarter (26%) said it made no difference at all. Among those affected, 40% paused recruitment, 21% delayed investment, and 20% reduced headcount - while 13% have turned to freelancers and contractors to stay flexible.

Tech and AI Adoption Gaining Momentum

Another clear trend in the data is the rapid adoption of AI and automation tools since the last Budget. Businesses across all sizes are increasingly embracing technology such as chatbots, CRM systems, inventory optimisation tools and cloud-based accounting. Generative AI tools like ChatGPT and CoPilot have seen the biggest surge in uptake (27%), followed by finance and banking software (19%) and CRM systems (16%).

However, adoption remains uneven - 26% of businesses have yet to explore these tools, rising to 58% among sole traders. By contrast, only 12% of mid-sized businesses say they haven’t yet taken the leap.

What SMEs Want from the Upcoming Budget

When asked what measures they most want to see from the Chancellor, improving access to finance for small businesses topped the list (22%) - tied with reversing the recent National Insurance increases. One-fifth (20%) are calling for stronger trade relations with the EU.

Among mid-sized businesses, there’s also appetite for more support to improve digital skills and to help UK firms expand into international markets through UK Export Finance.

As the Budget approaches, we’ll continue to track sentiment among UK business leaders and share insights on how policy decisions are shaping the SME landscape.