A rise in M&A and investment has shown 2021 to be a year of opportunity

At ThinCats, we are seeing all types of activity from acquisitions, management buyouts, employee ownership schemes and general refinancing. At the same time, some business owners who saw their way through the pandemic have decided that it's time for them to exit and hand their business on, creating opportunities for acquirers.

For many firms, 2020 was all about survival, but this year is all about expansion and new opportunities. The first half of 2021 saw UK business change gear - growth was back, investment and lending up and more deals being done.

The latest research from credit analysis group Experian shows M&A deal activity increased in the first six months of this year reaching £150 billion in value, up 12% on the first half of 2020. The number of deals is rising too with 3,385 M&A deals so far this year, up 16%. This pick-up in M&A action has seen borrowing needs widen from funding operations to survive the impact of pandemic restrictions during 2020, to funding to support growth. There is a pent-up demand from deals that were postponed due to the pandemic, and businesses are re-evaluating their strategies and seeing opportunities for expansion.

But the market for funding M&A has not just grown, it has also changed shape. In the mid-sized SME sector for loans of between £1 million and £20 million, alternative lenders are taking a much bigger share of those deals. Alternative lending was already growing, but the pandemic has accelerated that growth as the big five High Street banks have largely stepped back from pursuing new business in this space.

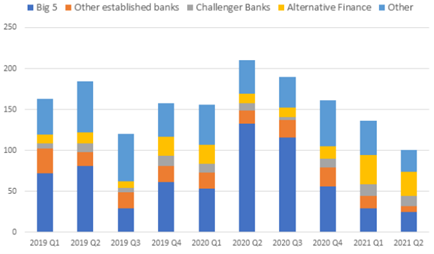

The latest Experian M&A report covering the first six months of 2021 showed only two of the top five lenders by deal volume were from the big 5 high street banks. The other positions were held by a challenger bank and two non-banks lenders which included ThinCats. This represents a significant changing of the guard since 2019 as shown by the chart below.

M&A transactions involving debt funding

High Street bank models make acquiring and servicing new business in the mid-sized SME sector too costly. Regulatory requirements on capital undermine the economics for these big players. The result has been High Street banks have focused on servicing their existing clients and seeking new business among larger corporates, where their own business models make economic sense.

Many of the big banks have lost the experience and skills in client relationship management. If firms lose that sense of contact, they will seek it elsewhere and that often means going through an adviser and finding alternative finance. Mid-sized SMEs find that alternative finance can provide real flexibility and service and do not just try to squeeze the client's needs into a standard product.

One factor that has helped lending to mid-sized business has been the government support schemes, notably the Coronavirus Business Interruption Loan Scheme (CBILS), for which ThinCats was accredited as one of the first non-bank lenders. Unlike the banks which focused on lending to existing customers only, ThinCats was able to offer CBILS to new borrowers. CBILS provided the headroom for many companies and management teams, not just to keep on trading, but to think bigger and to think differently.

Further support for business is still available. The Recovery Loan Scheme (RLS) was launched in April 2021 and is available for loans of between £1 million and £10 million. There has been much less fanfare around RLS than previous schemes and there is a risk that businesses for whom RLS would be suitable might overlook the opportunity. ThinCats has been accredited by the British Business Bank to offer lending through the RLS and can offer real flexibility, particularly on deals above £5 million.

By Mike Hackett, Head of Business Development, ThinCats