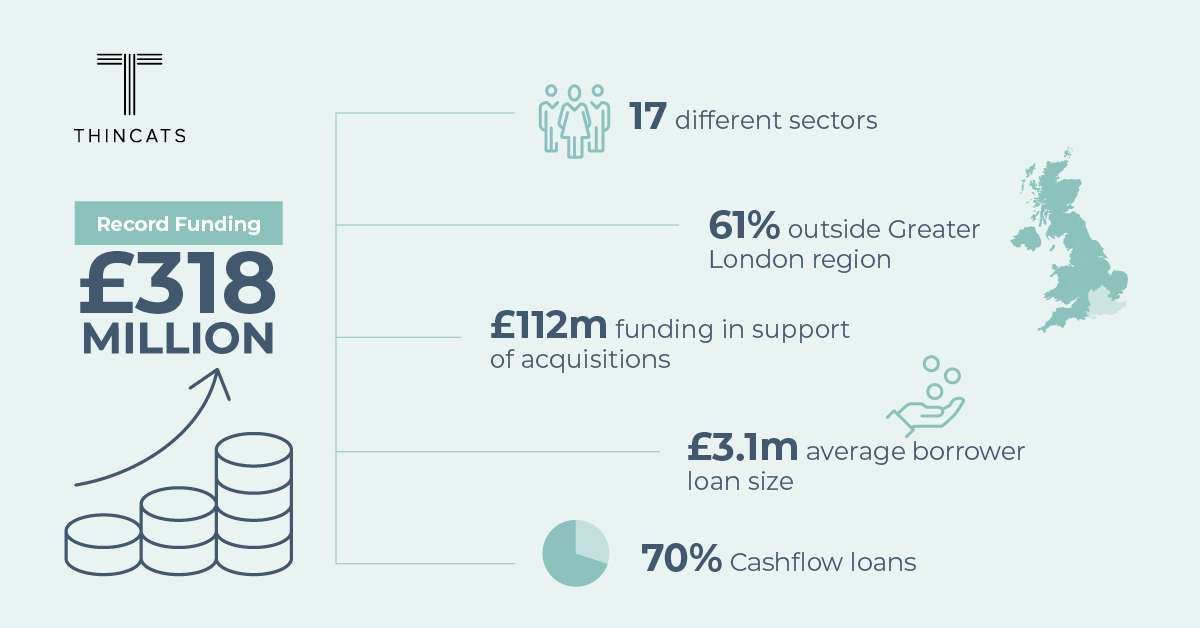

Record year for ThinCats with £318 million funding for SMEs

We have provided a record £318 million of funding to support mid-sized SMEs during 2021. In total, we have lent more than £1.2 billion to businesses across the UK.

Amany Attia, CEO, ThinCats: “As Covid restrictions lifted and business confidence strengthened during 2021, borrower demand switched from the short-term liquidity needs of 2020 to funding strategic growth plans, both organic and through acquisitions. Using a combination of the CBILS and RLS government-backed schemes and BAU lending, we were delighted to provide a record amount of funding to existing and new borrowers.

An important milestone during 2021 was a £160 million investment commitment from Wafra Capital Partners which will enable us to lend more than £2 billion over the next few years of which £600 million is ready to deploy now. We also made good progress in our established Healthcare and Leisure specialist lending products where we passed through £200 million funding in aggregate. Funding M&A transactions was another busy area for us, particularly those involving private equity sponsors.

The economic outlook remains uncertain given the emergence of the Omicron variant of Covid on top of already rising energy and input costs, ongoing supply chain disruption and staff shortages. It is unclear how long these challenges may persist, which is why businesses continue to need access to flexible funding solutions. Given such a fast-changing environment, I am really pleased that we have been able to respond quickly to the opportunities and challenges faced by our borrowers in 2021 and this will remain our top priority for 2022.”

You can read our full Annual Review 2021 here.