No place for old-fashioned funding in care of the elderly

Durable business models are underpinned by strong demographic drivers. That’s certainly the case with healthcare: individually and collectively, we’re not getting any younger, for a start. This, perhaps uncomfortable fact, supports the growth of care homes for the elderly.

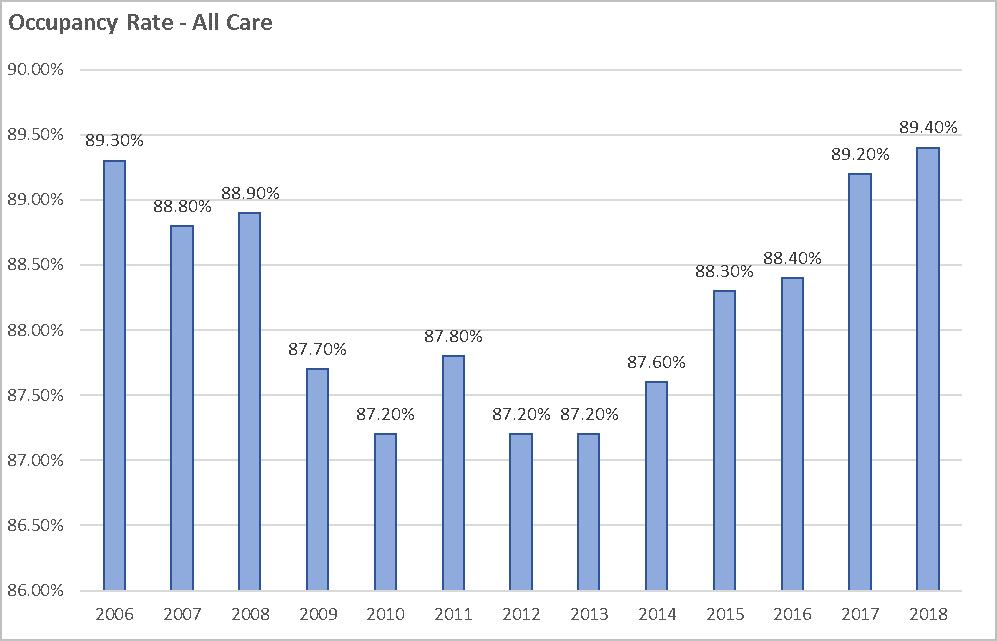

The sector is worth around £61bn, with 520,000 residents, and demand for care home bed provision is increasing, with the UK’s over-65 population forecast to rise from 11.6m in 2016 to 12.9m by 2021. As a result, occupancy rates have hit a record high, increasing for the sixth consecutive year to 89.4% in 2018 (see chart).

However, provision isn’t keeping up with this demand. In fact, in many respects, it’s going the other way. In 2016, care homes and bed numbers shrank by 11% and 5% respectively. Market analyst Knight Frank has estimated that 6,000 beds annually will be decommissioned in older style unsustainable homes before 2021.

In order to redress this – and accommodate a population in need of its services – the sector needs finance. With larger operators, big institutional funds are significant providers of capital, such as large infrastructure funds, seeking to diversify their portfolio from the traditional PFI models, according to market analysts Savills. Knight Frank, too, notes Asia Pacific and infrastructure funds “are now firmly the new money in town,” supplanting the previous big players, UK and US real estate investment trusts (Reits).[2]

Fragmented market

These funds are going for large allocations of capital: tens to hundreds of millions of pounds. For example, last year pan-European Reit, AEDIFICA acquired a 93-home portfolio for £450m. But that is only a part of the puzzle: the sector is highly fragmented, with major providers accounting for just 25% of the market. The balance is made up of small and medium-sized enterprises, more often than not owner-managers.

For most incumbents, running one or a handful of care homes, approaching an Asian sovereign wealth fund for finance isn’t an option. Both our experience and analysis shows that there is a swathe of businesses - that are well positioned, well run offering a much needed service to their clients, but in need of finance to capitalise on the inherent opportunity. They may be looking to expand existing provision through the development of existing operations, acquire a strategically placed additional home or to recapitalise punitive debt that incumbents have been forced to utilise as the traditional funding has retrenched.

There is a whole layer below the large operators that are really strong businesses: owner managed, playing a really positive role in their communities – quality operations that can’t readily access funding from traditional high street sources.

While the traditional banks have been an obvious recourse for loan capital, they have proven reluctant to lend to small businesses, driven by a combination of loss of experienced Relationship Directors and the increased focus on capital-adequacy regulations. And it’s not just access to capital that’s the problem, but also that the terms on which it’s offered can be punitive. Even where traditional funders are prepared to lend, the conditionality and controls mean that in many instances the funding remains inaccessible.

An alternative approach

Thankfully, as banks have withdrawn from these areas of the market, other lenders have come in – picking up the skills and sector expertise that businesspeople used to be able to rely on with their banking relationships.

ThinCats combines an alternative source of capital with traditional lending expertise. This allows us to structure finance packages that serve our borrowers’ needs, not the risk profile of a bank’s loan book. At ThinCats, we structure around your cash flows, rather than offering an off-the-shelf product. Despite most homes being cash generative banks are constrained from lending to them due to asset class, location or simply asset coverage. However, this suits perfectly ThinCats’ cashflow-based approach, we offer a friendly face, and a creative solution suited to your business needs.

[2] UK Healthcare Property 2018, Autumn-Winter Overview, Knight Frank