Mid-sized SMEs demonstrate resilience although insolvency rates expected to rise in 2023

We are forecasting a rise in business insolvencies during 2023 as the effects of pandemic support programmes dwindle and more recent economic challenges take precedent. Nevertheless, we expect current high demand for funding to continue in support of businesses seeking to grow organically or through acquisition.

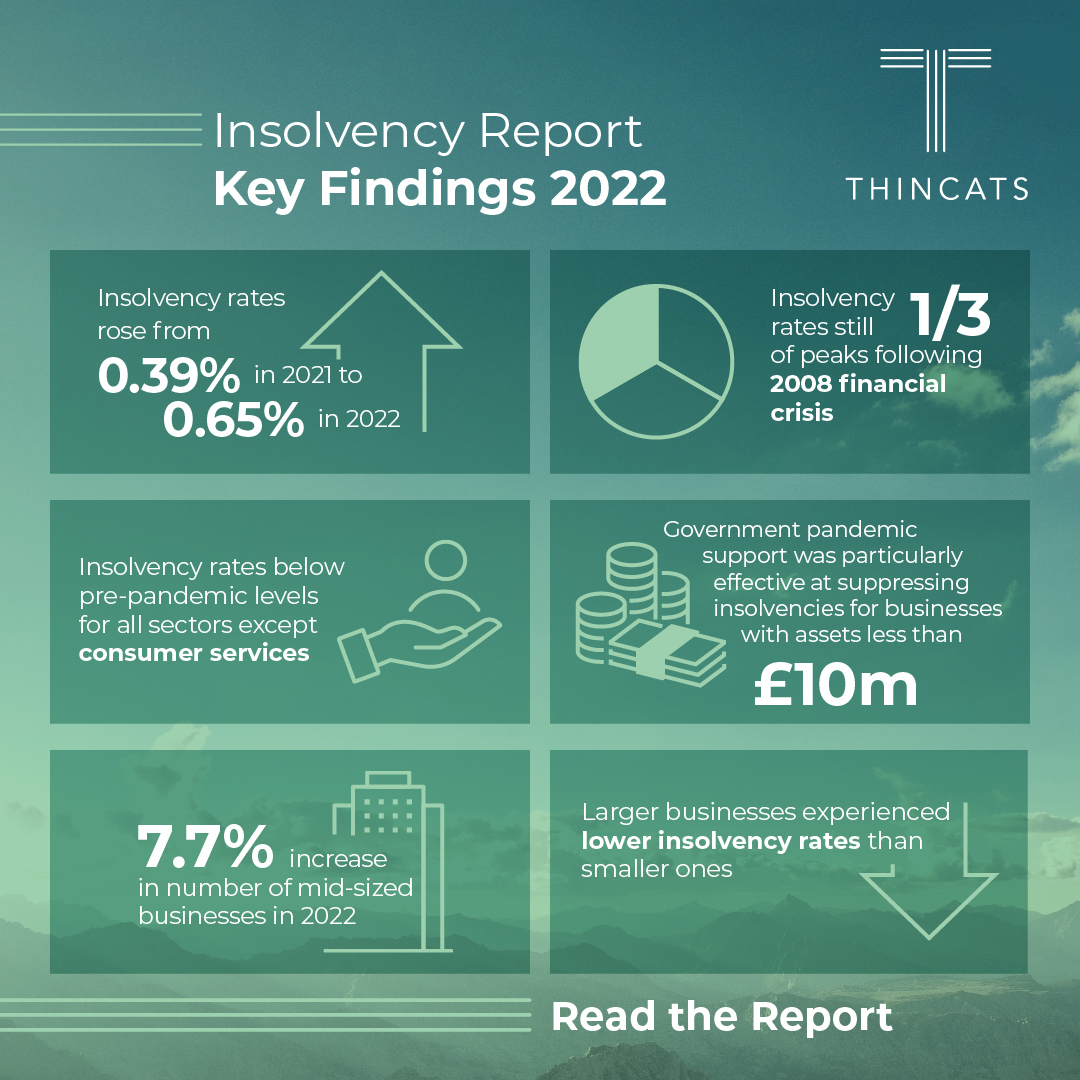

Our latest analysis of more than 500,000 UK businesses, Mid-sized SMEs Insolvency Report 2022 reveals the following findings:

This report sheds light on the continued resilience of more than half a million mid-sized SMEs that make a critical contribution to the UK economy. We expected an element of “catch up” in 2022 insolvencies following the easing of pandemic support measures, which had helped sustain many businesses during 2020 and 2021

Amany Attia, CEO, ThinCats

“Unfortunately, mid-sized businesses were also hit by a dangerous cocktail of rising inflation and input costs during 2022 so it is a credit to their ongoing resilience and adaptability that insolvency rates remained below their pre-pandemic levels. The robustness of the sector is further demonstrated by the addition of 38,000 businesses to the overall mid-sized universe during 2022.

“Historically, mid-sized businesses are more resilient than smaller ones and we expect this to become increasingly relevant if economic conditions weaken from here, although recent Bank of England forecasts suggest any downturn could be shallower and shorter than predicted a few months ago.

“Looking forward, although we believe insolvency rates for mid-sized businesses will continue to rise during 2023, perhaps above pre-pandemic levels in some sectors, many businesses are thriving in the current environment and will need additional funding to accelerate their growth trajectories. We are not seeing significant increases in stress levels from either our existing borrowers or in our new business pipeline which remains strong.”