Funding in a post pandemic world – supporting the mid-sized businesses that will drive the economic recovery

With the UK vaccination programme well under way and global stock markets switching their attention from “stay-at-home” businesses to cyclical stocks most likely to benefit from economic growth, the funding debate moves on from survival funding to recovery funding and how to support businesses in making the most of the growth opportunities that will appear.

The mid-sized SME sector has a critical role to play in delivering a significant part of the UK’s post-pandemic growth so it’s important that funding is available for the investment that these businesses will require.

The role of bank lending

Banks have played a huge part in delivering almost 1.6m business loans worth more than £70bn via the three main government backed schemes1; £44.7bn through Bounce Back Loans (BBLS), £20.8bn through Coronavirus Business Interruption Loan Schemes (CBILS) and £5.1bn through Coronavirus Large Business Interruption Loan schemes (CLBILS).

Evidence given by four of the big five high street banks at a Treasury Committee in December suggested that BBLS saw a huge increase in smaller businesses taking on external finance for the first time, whereas most of the CBILS funding was from businesses that had borrowed previously and would have sought funding outside of the CBILS scheme had it not been available2.

In terms of deployment of the lending, the banks estimated that approximately 50% of BBLS funds had been deployed, whereas for CBILS, a much higher proportion had already been used.

The banks also highlighted that they had seen lower insolvency levels than in normal years due to the government support schemes. However, this raises a question about whether this will lead to a ramp in insolvencies further down the line as businesses that would normally have gone under were able to continue.

Given ThinCats’ focus on funding mid-sized SMEs, we have been providing CBILS loans from £1m up to the £5m maximum since becoming one of the first alternative lenders to be accredited by the British Business Bank at the end of April 2020.

Our analysis of mid-sized businesses borrowing more than £1m suggests that there were approximately 10,000 borrowers during 2020 compared to 20,000 in a typical year. Of these 10,000 borrowers we estimate 5,000 borrowed under the CBILS programme. So, unlike smaller businesses who rushed to take advantage of “free money” through BBLS, we believe there was less overall lending to mid-sized businesses during 2020 despite the attractions of CBILs.

Reasons for this may be that mid-sized businesses had better existing liquidity levels to deal with the initial shocks brought by the pandemic and wanted to assess the business landscape before committing to any new funding. Alternatively, some may have required funding that did not qualify for CBILS but struggled to secure finance for this given the industry’s focus on the government backed loan schemes. From recent conversations with corporate finance advisers, we believe there is significant pent-up demand to fund transactions such as MBOs which did not qualify for CBILS.

Can we learn from the most recent financial crisis?

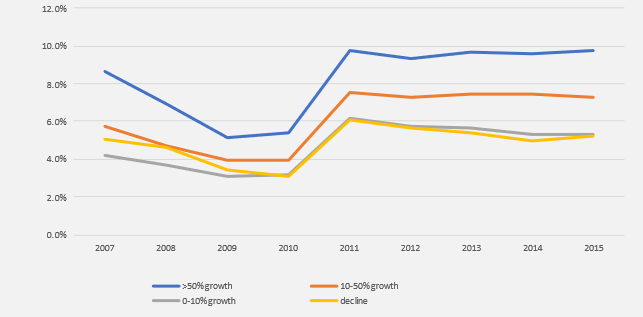

We looked at the difference in funding needs between mid-sized SMEs with differing growth rates in the aftermath of the Global Financial Crisis (GFC) to see if any parallels could be drawn with a post-covid pandemic recovery.

Chart 1 shows that fast growing businesses had a much greater demand for funding than slower growing businesses as the UK economy emerged from the GFC. Unfortunately, these fast growing businesses are the ones that the banks are less inclined to support.

Given the huge commitment made by the banks during the pandemic, we believe banks may be limited in providing further funding to mid-sized businesses by:

- Their high existing exposure to SMEs

- Large commitment and resources needed to pursue the debt recovery process for BBLS and CBILS defaults in order to qualify for the government guarantee

- Capital adequacy rules requiring banks to put aside more capital when lending to smaller and mid-sized SMEs

- Lack of appetite to fund growth businesses with higher perceived risk through cashflow loans

- Inflexible credit processes and expertise in being able to create the bespoke funding structures required

The role of non-bank lenders in funding mid-sized, growth businesses

The non-bank lending sector emerged following the Global Financial Crisis to fill the funding gap as banks cut back on lending to their business clients in order to protect their deposit holders.

In the UK, alternative finance platforms such as Funding Circle, Market Finance and Iwoca have carved out a niche to meet the needs of smaller businesses with straightforward funding needs, whilst direct lending funds which originated from the US, have attracted substantial capital from institutional private debt investors seeking attractive risk-adjusted returns.

For mid-sized businesses, the growth of private debt as an asset class of interest to institutional investors is good news for the long term. However, direct lending funds have so far focused primarily on providing debt to larger corporates at the expense of smaller and lower-mid market businesses.

The British Business Bank in conjunction with the British Private Equity & Venture Capital Association recently issued its first report on Private Debt focusing on this sector of the market3.

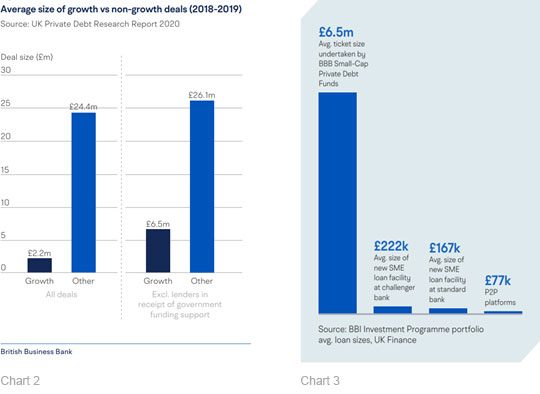

Looking at 55 UK focused direct lending funds managed by 37 fund managers, the report covered 934 deals across 2018 & 2019 totalling £18.4bn. The report showed that for certain deal types direct lending funds may be coming more into reach for mid-sized businesses; for deals defined in the report as growth (as opposed to buyouts, acquisitions or refinancing) the average deal size was £6.5m reducing to £2.2m for lenders in receipt of government funding support. However, the average for other deal types – buyouts, acquisitions or refinancing – was around £25m. [see chart 2]

Chart 3 shows that for lending via the British Business Bank small-cap private debt funds the average deal size was £6.5m compared to £222k for challenger banks, £167k for standard banks and £77k for P2P. This shows there remains a significant gap for funding and expertise in the £1-£5m sector.

ThinCats is trying to fill this gap.

ThinCats is looking to fill this gap by providing loans between £1m-£15m to UK mid-sized businesses for all purposes including growth, refinancing and acquisition. Like direct lending funds we deploy institutional investor capital, however, we also deploy our own balance sheet capital alongside this. The main difference between our model and direct lending funds is that we create bespoke investment portfolios for each institutional investor.

Since we started deploying institutional capital in late 2017, the average loan size we fund has risen from £1.75m to £2.8m and we expect this to grow to more than £4m over the next 3 years.

We believe that our model of using a combination of institutional capital and our own capital provides the scale and flexibility of funding required by mid-sized SMEs, particularly as businesses invest into the post-pandemic recovery while banks remain cautious. Longer term, the potential for alternative finance providers, like ThinCats, to play a larger part in funding UK businesses of all sizes, including the mid-sized, is huge and we look forward to being an important facilitator of this.

References:

Source British Business Bank 28/01/21

Source Treasury Committee: Economic impact of coronavirus 14/12/20 https://committees.parliament.uk/event/3077/formal-meeting-oral-evidence-session/

Source UK Private Debt Research Report 2020