Funding for the fast-changing IFA sector

The community of UK independent financial advisers and wealth managers is undergoing dramatic change as existing and new entrants pursue ambitious buy-and-build plans while incumbents consider the best exit strategies for their personal circumstances.

ThinCats is increasingly active in this space providing debt funding to support those looking to buy and those looking to reduce their shareholdings.

Growth through acquisition

Acquisition of UK independent financial advisers (IFAs) is at all-time highs according to recent research, as private equity backed ‘consolidators’ dominate the market. But there is an alternative path for advisory firm owners seeking to achieve their growth targets.

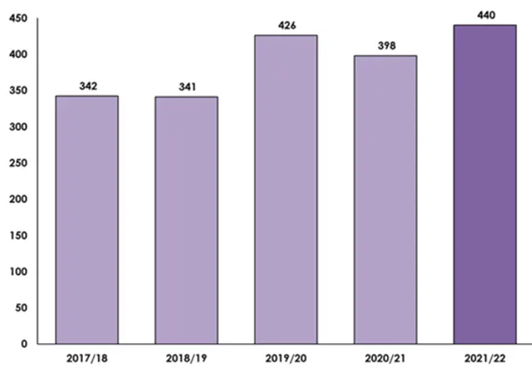

The number of acquisition deals involving UK IFAs and wealth managers rose by 11% in the year to September 2022, climbing from 398 to a record high of 440. The surge was driven by huge amounts of private equity investment, a trend that shows no sign of abating, according to data from international law firm Mayer Brown.

Acquisitions of UK IFAs and wealth managers over past five years

Source: Mayer Brown

A natural consolidating market

The characteristics of the IFA sector make it ripe for consolidation. IFAs are resilient businesses with strong recurring revenues but an increasing regulatory burden which require scale to operate effectively. Running alongside this is an increasingly ageing population with growing wealth looking for advice around investments and retirement plans

The industry remains highly fragmented, comprising thousands of small independent firms and self-employed advisers, many of which are regionally focused. More than 30% of IFAs still have five advisers or fewer, according to the FCA (Source FCA retail intermediary analysis 2021).

The industry ownership demographic is another key factor driving consolidation in the sector. With many independent IFA firms owned by older advisers – around 17% of financial advisers are over 60 according to recent FCA data – there is a significant opportunity for consolidators to buy from owners keen to sell their businesses to fund retirement.

The personal nature of the IFA proposition needs to be countered with the need to scale operations. IFA business models, adviser incentive structures and use of technology have evolved to address this difficult balance.

As a result of these factors more firms are seeking to grow inorganically by acquiring firms and combining client books. In addition, private equity and other capital is attracted to the sector through the resilience offered by the recurring revenues and profitability.

Increasing regulatory pressure

As well as their age, IFA owners’ decisions to sell are also frequently driven by the pressure on them to scale their small businesses in order to justify increasing running costs, particularly in relation to the growing regulatory burden. Finding the time and resources necessary to achieve compliance with existing rules around TCF, offering appropriate risk rated portfolios etc The FCA’s Consumer Duty regulations coming into force from July this year sets even more rigorous standards of consumer protection and value for money and therefore create increasingly onerous reporting requirements. The impact is felt more acutely by independent firms, which must analyse, monitor, and report on a broad range of products, wrappers and platforms.

The alternative route: debt versus equity

For IFA businesses looking to scale through acquisitions rather than organically, a popular route in recent years has been to use private equity investment as the primary source of funding. This has often been done in combination with debt. ThInCats has been an active lending participant alongside private and other equity for more than 6 years.

The downside to private equity is that owners of the acquiring business need to sacrifice a proportion of their equity, often to a level where they are no longer the majority shareholder adding more complexity to a business which is driven by key client facing personnel. To provide an alternative, ThinCats’ has developed a ‘Transitional Capital’ solution, which can fund a larger debt quantum than usual, removing the need for equity, and also can provide committed capital to create a war chest for a buy-and-build strategy.

ThinCats recently partnered with owner-managed firm MWA Financial, to support the group’s plans to build a national firm of IFAs. The London-headquartered company plans to make a series of acquisitions designed to take adviser numbers to more than 30 and AUA above £1bn in the next 12 to 18 months. The partnership provides MWA with access to a pool of transitional debt capital, allowing it to execute its accelerated growth strategy and act quickly on any opportunities whilst maintaining 100% of the shareholding. It also positions the company as an attractive and capable owner-managed alternative to the proliferation of PE acquirers in the market.

Planning an exit strategy by selling to existing employees

For those owner-managers of IFA businesses looking to exit fully or partially there are various options.

- Sell their business to a consolidator IFA pursuing a buy-and build strategy as described earlier

- Sell to the existing management team through an MBO.

- Sell to a wider range of employees via an Employee Ownership Trust (EOT)

Each option has different considerations for the selling owner-manager including their level of involvement and influence with the ongoing business, the terms of when and how much they may receive for their equity holding, their desire to continue their legacy and look after their employees and minimising any potential disruption to the existing client base which has typically taken many years to establish.

While MBOs remain a popular exit route where ThinCats has funded many transactions, we are seeing increasing interest from owner-managers seeking to transfer ownership to their employees via an EOT. This trend is happening right across the UK and is well-suited to service businesses such as financial advisers.

ThinCats recently provided funding to help independent financial planning business Cheetham Jackson (CJL) transition to an EOT. Specialising in wealth management for the long term, CJL has 10 offices across the north of England and has worked hard to create a positive culture - a quality the existing owners are keen to retain as the business continues to grow. With our funding, CJL has a clear plan to execute over the next five years and - under EOT ownership - all employees will benefit as it achieves its growth goals.

Consolidation in the UK IFA sector looks set to continue with multiple options for both buyers and sellers to explore before committing to a particular capital event. For businesses looking to fund acquisitions without diluting equity, ThinCats’ transitional capital debt solution could be a relevant option.

The team at Cheetham Jackson celebrating the firm's transition to employee ownership