Adviser survey key findings 2019

ThinCats recently conducted a survey with corporate financial advisers on the current drivers, restrictions and trends in SME financing in the UK. Join us in this brief article as we collate the survey’s results on the funding market for SMEs, including the notable rise of alternative finance as a means to support SME growth.

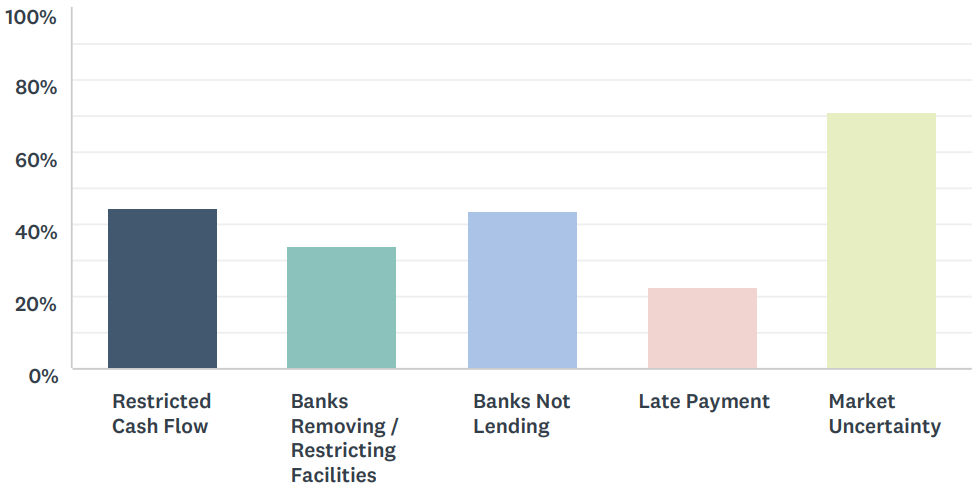

The biggest challenges for UK SMEs include market uncertainty

70% of survey respondents view market uncertainty as a serious difficulty for SMEs, whereas just over 40% view restricted cashflow as the second biggest challenge. A reliance on banks for finance is also a worry, with over 40% conscious of the possibility that they reject loan applications and over 30% concerned that they may remove credit facilities. However, market uncertainty, led chiefly by concerns over Brexit and more broadly by global tariff wars and their potential to act as a drag on global growth, is a constant theme.

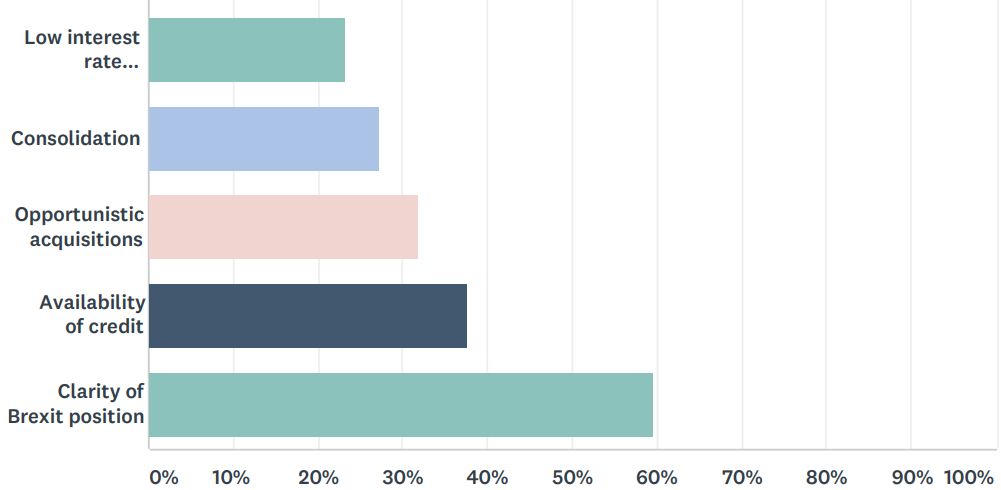

The main drivers of funding activity over the next 12 months

Brexit again is the dominant theme regarding funding activity. 60% of advisers believe that clarity on Brexit is the single most important element that will contribute to funding deal activity over the next 12 months. Just under 40% believe that availability of credit will be a deciding factor. Elsewhere, 31% highlight the possibility of opportunistic acquisitions and 23% the low interest rate environment.

Respondents predict that the main stumbling blocks for deal origination will come from Brexit uncertainty and unrealistic pricing.

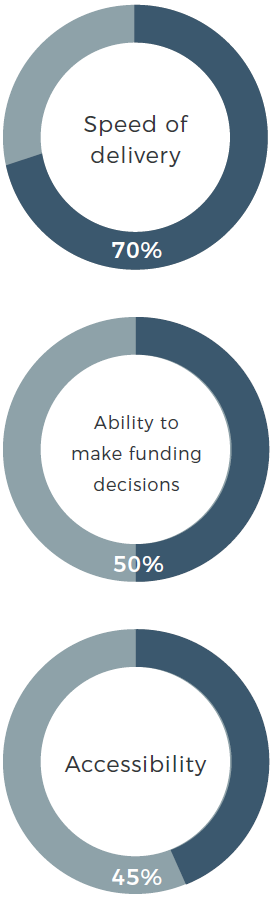

Alternative finance grows in prominence as a funding solution

Survey respondents see alternative funding providers, chiefly fintech companies, as a viable, and often superior, option for SMEs compared to traditional lenders. 98% of respondents agree that their clients are increasingly moving away from a sole reliance on traditional lenders by considering alternative funding providers too.

They value three benefits in particular that alternative providers are known for. 70% highlight their speed of delivery; 50% their ability to make agile funding application decisions; and 45% underline the importance of alternative providers for their accessibility, offering funding opportunities to SMEs that banks reject. However, 60% of respondents highlighted that a lack of awareness and understanding of alternative financing options, from SME owner-managers in particular, is restricting their access to potential funding solutions.