2019 SME survey reveals shift towards alternative finance for younger businesses

We recently surveyed more than 500 medium sized UK businesses about their experiences when seeking external funding: how often, how much, what for and where from.*

The results – in terms of the average business – were pretty much as expected.

Survey Findings

55% of businesses approached a high street bank as their first source for business finance

30% of businesses never seek external funding

There was a fairly even split between using an accountant, commercial finance broker or corporate finance adviser for funding advice or handling the search themselves

Working capital, fixed asset purchase, growth capital, acquisition and refinance were the most common reasons for seeking funding

A competitive interest rate was the most important factor when selecting a lender

27% had sought funding within the previous 12 months

What the headlines don't tell us

Scratch beneath the surface, however, by looking at different types of business based on their size, industry sector, company age and age of decision makers, and the data reveals a number of more nuanced findings.

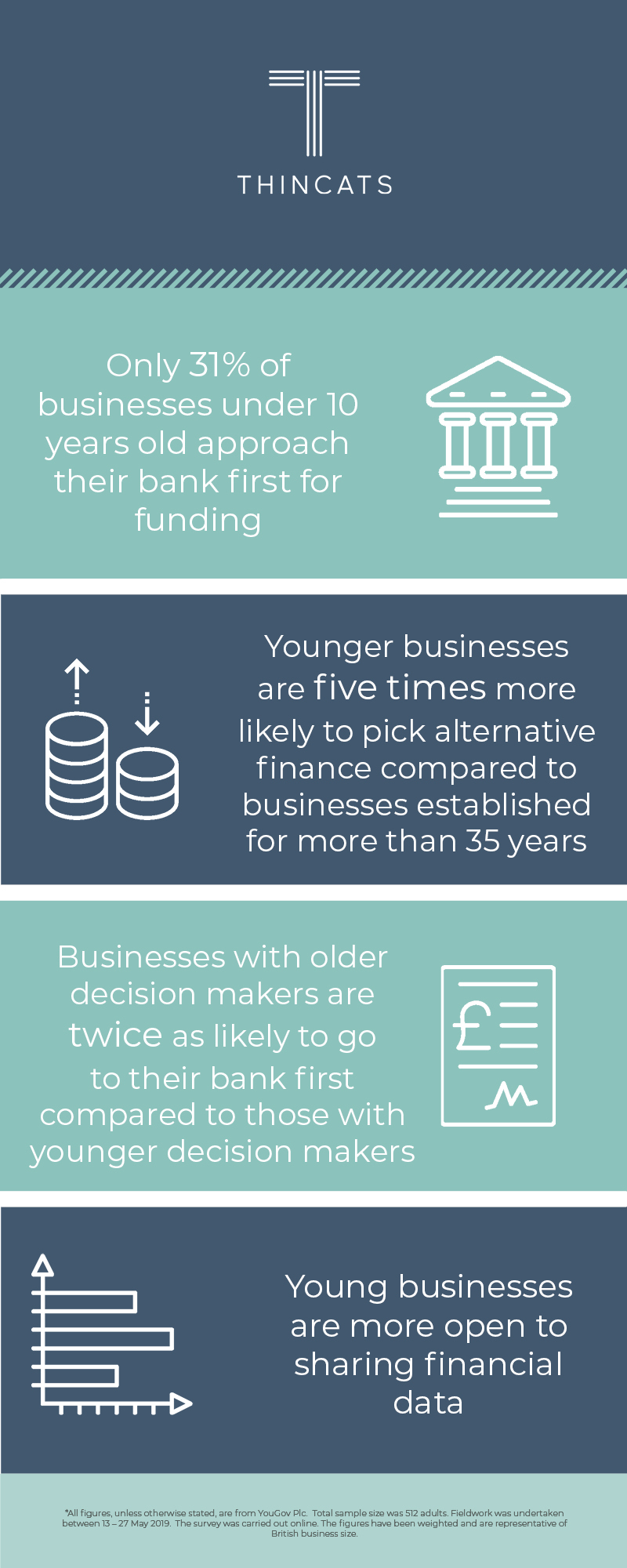

For example, for businesses less than 10 years old, only around a third (31%) approach their bank first when seeking funding compared to 61% for businesses established between 10 and 20 years ago, rising to 71% for those over 35 years old.

Younger businesses were also much more likely (22%) to pick an alternative finance platform as their first choice lender compared to just 4% of the oldest SMEs.

Likewise, in businesses where decision makers were aged under 35, approximately a third (35%) approached their bank first. Contrast this with 70% for those aged 55 + who approached their banks first.

Are established businesses with more experienced employees simply set in their ways and blind to new technology and innovations, or is something else going on?

Industry sector reveals funding trends

When you slice the data by industry sector, further clues are revealed. Preference for non-bank lenders is much higher with serviced-based businesses such as those in the IT, telecoms, media and marketing sectors when compared to sectors such as real estate, retail and manufacturing.

Traditionally, high-street bank lending focuses on asset-backed financing that requires businesses to provide a physical asset (such as equipment or property) as collateral for a bank loan. Yet, for many businesses in the modern economy, with few tangible assets, the traditional lending model does not align with how their business actually works: whilst it may be highly cash generative, it is penalised for having insufficient physical assets.

Although we did not research specific funding structures or security requirements, our own experience shows that 70% of the deals we currently fund are cash flow rather than asset-backed.

Why do businesses flock to particular lenders?

When we dug deeper into the reasons why businesses select particular lenders, we found some interesting differences. Although offering a competitive interest rate was, on average, the most important factor, for those businesses using corporate finance advisers, being able to offer a bespoke solution was the most important factor. Similarly, for businesses using commercial finance brokers, it was important that the funding application was considered by real people and not based solely on financial data.

In broad terms, for the more complex, higher value deals where businesses used external advice, it became more important for the lender to offer a more personal service and bespoke funding solution.

Another area we examined was the willingness of a business to share financial data with potential lenders through its accounting software packages, such as Sage, Xero, QuickBooks, etc.

On average, 42% of businesses said they would be willing to use their accounting package to share their financial data as part of the funding application process. The younger the business, the more open it was to sharing data: 59% of businesses established less than 5 years ago were happy to share their data, falling to 33% for businesses more than 35 years old.

Our thoughts

Commenting on the research findings, Damon Walford, ThinCats Chief Development Officer: “This is the first time we have researched mid-sized businesses on such a scale. It shows that for large, long established businesses with significant tangible assets, a traditional bank is still their first port of call.

However, younger businesses are waking up to the benefits of looking beyond their bank. This may be because they are more open to trying new things, although we suspect it is more about the service-based nature of many of these modern economy businesses which do not fit the asset-reliant models of the traditional lenders.

Cash flow lending is a solution for thousands of SMEs, where lenders look at the underlying cash flow generated by the business. For businesses who are service-focused like IT, telecoms and marketing companies it works perfectly. I hope this message gets out to more SMEs and would encourage them to plug into the growing network of accountants and commercial finance advisers now advising on alternative finance options.

It’s critical that UK entrepreneurs can access the modern funding solutions needed to support a modern economy.”

*All figures, unless otherwise stated, are from YouGov Plc. Total sample size was 512 adults. Fieldwork was undertaken between 13 – 27 May 2019. The survey was carried out online. The figures have been weighted and are representative of British business size.